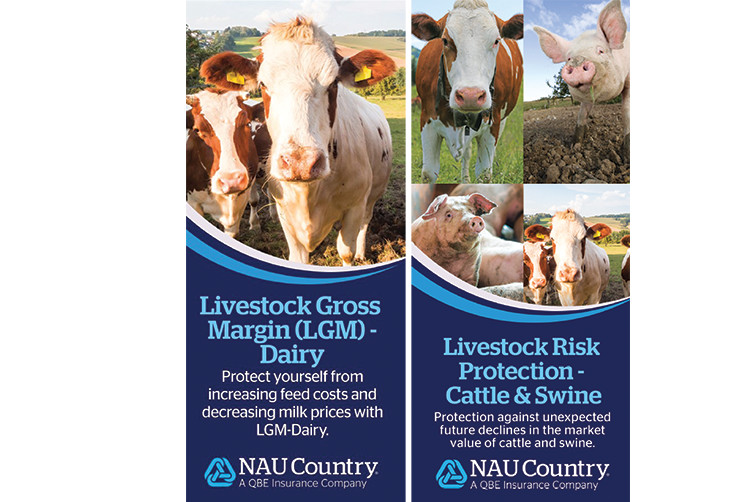

Comprehending Livestock Danger Security (LRP) Insurance Policy: A Comprehensive Overview

Browsing the realm of animals risk security (LRP) insurance can be an intricate endeavor for several in the agricultural field. This kind of insurance policy provides a safeguard against market variations and unexpected situations that could affect animals producers. By comprehending the intricacies of LRP insurance coverage, producers can make enlightened choices that may secure their procedures from financial dangers. From just how LRP insurance works to the different protection options readily available, there is much to uncover in this detailed overview that can potentially shape the method animals manufacturers approach risk management in their businesses.

How LRP Insurance Works

Occasionally, comprehending the mechanics of Animals Threat Defense (LRP) insurance can be complex, however damaging down just how it functions can provide clarity for breeders and farmers. LRP insurance policy is a risk administration device made to secure animals producers versus unanticipated rate declines. It's important to keep in mind that LRP insurance coverage is not an income guarantee; instead, it concentrates solely on price risk defense.

Qualification and Insurance Coverage Options

When it comes to coverage options, LRP insurance provides producers the flexibility to choose the insurance coverage level, protection duration, and endorsements that best fit their risk management needs. By recognizing the qualification standards and coverage choices offered, livestock producers can make informed choices to handle danger successfully.

Benefits And Drawbacks of LRP Insurance Coverage

When reviewing Animals Danger Security (LRP) insurance, it is important for animals manufacturers to evaluate the negative aspects and benefits fundamental in this risk management tool.

Among the key benefits of LRP insurance is its capacity to supply protection versus a decrease in livestock rates. This can assist safeguard manufacturers from monetary losses arising from market changes. Additionally, LRP insurance coverage offers a level of flexibility, permitting producers to tailor insurance coverage levels and policy durations to match their details needs. By securing a guaranteed cost for their animals, manufacturers can much better manage risk and plan for the future.

Nonetheless, there are additionally some drawbacks to consider. One limitation of LRP insurance is that it does not protect against all kinds of risks, such as disease outbreaks or natural calamities. Premiums can in some cases be costly, especially for manufacturers with big livestock herds. It look here is critical for manufacturers to meticulously examine their specific danger direct exposure and financial scenario to establish if LRP insurance policy is the ideal danger management device for their operation.

Comprehending LRP Insurance Policy Premiums

Tips for Making Best Use Of LRP Advantages

Taking full advantage of the advantages of Livestock Risk Protection (LRP) insurance needs critical preparation and aggressive threat administration - Bagley Risk Management. To take advantage of your LRP coverage, consider the adhering to tips:

Consistently Assess Market Conditions: Keep educated about market trends and rate variations in the livestock sector. By keeping track of these variables, you can make enlightened choices regarding when to acquire LRP protection to protect against possible losses.

Set Realistic Insurance Coverage Levels: When selecting coverage levels, consider your production expenses, market price of animals, and possible threats - Bagley Risk Management. Establishing reasonable insurance coverage degrees makes certain that you are sufficiently safeguarded without paying too much for unneeded insurance

Expand Your Insurance Coverage: As opposed to relying solely on LRP insurance policy, consider diversifying your risk management approaches. Incorporating LRP with other danger administration devices such as futures contracts or choices can supply detailed coverage against market uncertainties.

Testimonial and Readjust Protection On a regular basis: As market problems change, regularly evaluate your LRP insurance coverage to guarantee it aligns with your current threat direct exposure. Adjusting insurance coverage degrees and timing of acquisitions can help enhance your risk protection method. By adhering to these pointers, you can make best use of the advantages of LRP insurance and guard your animals operation against unexpected risks.

Verdict

In conclusion, livestock threat protection (LRP) insurance policy is an important device for farmers to manage the economic risks related to their animals get redirected here procedures. By understanding exactly how next page LRP functions, qualification and protection choices, along with the advantages and disadvantages of this insurance coverage, farmers can make informed decisions to shield their source of incomes. By thoroughly thinking about LRP premiums and carrying out strategies to make best use of benefits, farmers can alleviate prospective losses and make certain the sustainability of their operations.

Animals manufacturers interested in getting Animals Danger Security (LRP) insurance coverage can discover a range of eligibility standards and insurance coverage alternatives customized to their particular livestock procedures.When it comes to protection options, LRP insurance offers producers the adaptability to pick the insurance coverage degree, insurance coverage duration, and recommendations that ideal match their danger monitoring demands.To realize the intricacies of Animals Threat Protection (LRP) insurance coverage completely, recognizing the variables influencing LRP insurance premiums is crucial. LRP insurance costs are established by numerous aspects, including the coverage degree picked, the anticipated cost of livestock at the end of the coverage duration, the kind of livestock being insured, and the size of the insurance coverage duration.Review and Adjust Protection Routinely: As market problems alter, occasionally examine your LRP protection to ensure it straightens with your present risk direct exposure.